Maximizing Your Retirement Savings: Understanding the Financial Benefits of Senior Living in Georgia

As retirement approaches, it’s important to consider the full scope of retirement planning—including housing, healthcare, and day-to-day living expenses. For older adults exploring their options, senior living communities in Georgia can offer several financial advantages. These may include cost savings on home maintenance, utilities, and transportation, as well as potential tax benefits and access to bundled services.

In this article, we’ll explore the following:

- Senior Living Community vs. Aging at Home

- Tax Benefits for Seniors in Georgia

- What’s Included in Senior Living Costs

- Financial Resources to Afford Senior Living

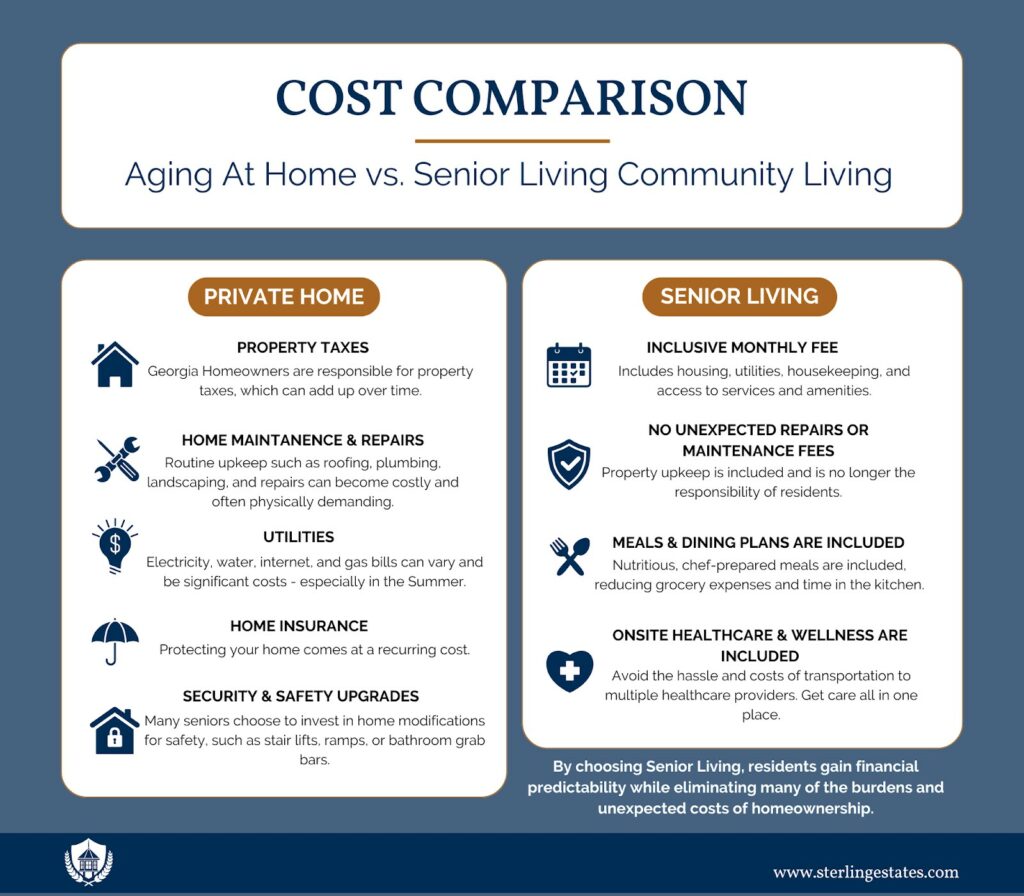

Cost Comparison: Senior Living Community Versus Aging at Home

Many seniors assume that staying in their house is the most affordable choice in retirement. However, when factoring in all associated living expenses, moving to a senior living community can often be a more affordable and smarter financial decision.

Below is a cost comparison between living in a senior living community vs. staying at home.

Homeownership Costs:

- Property Taxes: Georgia homeowners are responsible for annual property taxes, which can add up over time.

- Home Maintenance & Repairs: Routine upkeep such as roofing, plumbing, landscaping, and repairs can become costly and often physically demanding.

- Utilities: Electricity, water, internet, and gas bills vary but can be significant costs, especially in the summertime..

- Home Insurance: Protecting your home comes at a recurring cost.

- Security & Safety Upgrades: Many seniors choose to invest in home modifications for safety, such as stair lifts, ramps, or bathroom grab bars.

Senior Living Community Costs:

- Inclusive Monthly Fee: Includes housing, utilities, housekeeping, and access to services and amenities. A fixed monthly cost allows you to budget and plan appropriately.

- No Unexpected Repairs or Maintenance Costs: Property upkeep is included and is no longer the responsibility of the residents.

- Meals & Dining Plans Are Included: Nutritious, chef-prepared meals are included, reducing grocery expenses.

- On-Site Healthcare & Wellness Programs Are Included: Avoid the hassle and costs of transportation to multiple healthcare providers. Get care all in one place.

By choosing a senior living community, individuals gain financial predictability while eliminating many of the burdens and unexpected costs of homeownership.

Tax Benefits for Seniors in Georgia

Georgia is one of the most senior-friendly states when it comes to taxes, offering multiple financial advantages. These advantages make senior living communities an attractive option for retirees looking to maximize their savings and live life to the fullest. Georgia provides several tax advantages for retirees that can make senior living even more affordable. Some key benefits include:

- No State Tax on Social Security Income: Seniors do not pay Georgia state taxes on Social Security benefits, leaving more money available for living expenses.

- Retirement Income Exemptions: Georgia offers retirement income deductions of up to $65,000 per person for individuals aged 65 and older. This applies to income from pensions, IRAs, and other retirement accounts.

- Property Tax Exemptions: Many counties in Georgia provide property tax exemptions or reductions for seniors. If you’re downsizing from a home to a senior living community, you may benefit from significant property tax savings.

- Affordable Cost of Living: Georgia’s overall cost of living is below the national average, which can lead to additional savings when combined with a senior living community’s inclusive pricing.

These tax benefits, combined with predictable monthly expenses, provide financial peace of mind and allow residents to enjoy a vibrant, worry-free lifestyle.

Here are some Helpful Resources to Explore Georgia’s Tax Benefits for Seniors

Georgia Department of Revenue – Retirement Income & Tax Guide

Use this site to:

- Review retirement income exemptions and eligibility

- Access downloadable forms and tax booklets

- Find updates on income tax policies affecting seniors

Georgia Tax Exemptions for Seniors (via Georgia.gov)

Search “Senior Tax Exemptions” to find:

- Property tax exemptions by county

- Age-specific exemptions for homeowners

- Step-by-step guidance for applying

Included Services & Savings at Senior Living Communities

One of the key financial advantages of senior living communities is the wide range of services that are bundled into a predictable monthly cost. These inclusive offerings not only simplify budgeting, but also reduce the time, energy, and money spent managing a household independently.

1. All-Inclusive Dining & Nutrition

Many communities include chef-prepared, dietitian-approved meals as part of their monthly plan. This eliminates the need for grocery shopping, meal preparation, and frequent dining out—saving both time and money while ensuring access to balanced, nutritious food.

2. Wellness & Healthcare Services

Access to on-site medical support can reduce reliance on external providers and lower overall healthcare costs. Services may include routine wellness checks, medication management, fitness programs, and 24/7 emergency response systems—many of which are costly or unavailable in a private home setting.

3. Recreational & Social Activities

Group exercise classes, clubs, cultural outings, and special events are typically included in community life. These offerings provide meaningful engagement and social interaction—without the added expense of outside memberships or entertainment fees.

Financial Planning & Resources for Senior Living in Georgia

Exploring senior living options often comes with questions about affordability. Fortunately, there are several financial resources available to help older adults and their families navigate the cost of care and housing with greater confidence and clarity.

1. Long-Term Care Insurance

If you have a long-term care insurance policy, it may help cover costs associated with assisted living or personal care services. These benefits can reduce out-of-pocket expenses and provide added peace of mind when planning for future needs.

2. Veterans Benefits

The VA Aid and Attendance Benefit is a valuable resource for eligible veterans and their surviving spouses. This monthly payment is designed to help cover the cost of care, including support with daily living activities in a senior living setting. Eligibility is based on service history, income, and level of need.

3. Life Settlements & Reverse Mortgages

Older adults who no longer need life insurance coverage may consider a life settlement, which allows them to sell their policy for a lump-sum payment that can be used toward care costs.

Reverse mortgages are another option for homeowners, offering access to home equity without requiring an immediate move or sale. This can help bridge the gap while transitioning to senior living.

👉Helpful resources:

In some circumstances, Health Care can be tax deductible. Here is some information concerning tax deductibility of Assisted Living expenses.

In some circumstances, independent living fees can be tax deductible. Here is some useful information concerning tax deductibility of Independent Living expenses.

*Always talk to your accountant or financial advisor to make certain that you get accurate and actionable information regarding your particular circumstances.

Why Sterling Estates is a Smart Financial Choice

Choosing senior living in Georgia at Sterling Estates means embracing a financially secure, maintenance-free, and fulfilling lifestyle. With lower overall costs, tax benefits, and included services, residents can enjoy peace of mind knowing they are making smart financial decisions for the future.

If you’re considering a senior living community for yourself or a loved one, contact Sterling Estates today to learn more about our floor plans, pricing, and financial options. Schedule a tour or request more information to explore how our community can enhance your retirement years.